30+ How much can 8 borrow mortgage

Find out How Much You Can Borrow for a Mortgage using our Calculator. 2022 USDA mortgage May 17 2022.

Bringing It Home Raising Home Ownership By Reforming Mortgage Finance Institute For Global Change

In reality its much more complex.

. How much do houses cost. Most mortgage lenders will consider lending 4 or 45 times a borrowers income so long as you meet their affordability criteriaIn some cases we could find lenders willing to go up to 5 times income. How long will I live in this home.

The calculator also helps you determine the effects of different interest rates and levels of personal income on how much mortgage you can afford. Your down payment affects how much you can borrow for a mortgage. The new loan can help cut monthly costs or pay off the loan quicker with a new loan term.

By taking into account all of those numbers you. Business Find out how we can help your business. Our TravelMoneyMax tool compares 30 bureaux to max your holiday cash.

In a few exceptional cases you might be able to borrow as much as 6 times your annual income. Borrowers within this limit typically receive more favourable mortgage rates. Keep in mind how much you can afford to borrow without putting the rest of your financial plans on hold.

The average mortgage interest rate is around 55 for a 30-year fixed mortgage. Or 4 times your joint income if youre applying for a mortgage. How much you can borrow for a mortgage.

Offers Flexible Terms from 8 to 30 Years. Please call us to discuss. Income credit and finances youll have a better idea how much you can borrow.

The example above assumes a 30-year fixed-rate mortgage with a 375. It will depend on your Salary Affordability Credit score. For example if you purchase a new home for 100000 and borrow 90000 90 you would put 10000 down on the house.

As of December 2020 the. Most UK lenders consider 20 to 30 a low-risk range. Bankruptcy is a legal proceeding involving a person or business that is unable to repay outstanding debts.

When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you can borrow. Extra Details Loan terms. Refinancing a mortgage refers to getting a new loan to replace your current mortgage.

You must consider the homes price the amount of your deposit and how much you can set aside for monthly mortgage payments. Check rates today to learn more about the latest 30-year mortgage rates. You are looking to change from your current rate to a new mortgage and borrow more on top of what you owe on your current mortgage.

The CMHC Mortgage Loan Insurance premium is calculated as a percentage of the loan and is based on the size of your down payment. Mortgage Rate 30-Year Fixed 3125. Including Treasury securities and agency mortgage-backed.

Products services Accounts borrowing online banking and merchant services Business Specialists Find the specialist who best understands your kind of. That doesnt mean you have to borrow the entire amount if it would put you under significant financial strain. Rates are influenced by the economy your credit score and loan type.

This can help you build a stronger future because youll be better informed and better equipped to be a successful. That can greatly impact your decision on whether to choose a 30-year fixed rate loan or a shorter term. The longer term will provide a more affordable monthly.

Borrowers also can release their co-signers after 36 monthly payments and graduates can refinance federal PLUS loans in their own names that their parents took out. The federal government is projected to borrow another 18 trillion from the end of 2021 through 2032. You could access 30 more of the mortgage market with a broker on your side Get Started with an OMA-Expert to find out how much this could save you and unlock more deals.

For example a 30-year fixed mortgage would have 360 payments 30x12360. A shorter term on the mortgage means it goes away sooner but at the cost of a much higher monthly payment and perhaps some out-of-pocket closing costs. How much can you borrow.

Determining how much mortgage you can afford depends on a variety of factors such as your income expenses credit history and existing debt. Premiums in Quebec Ontario and Saskatchewan are subject to provincial. 8 Ways To Get A Mortgage Approved And Not Mess It Up May 26 2016 4 ways to keep your mortgage closing costs low June 22 2017 USDA eligibility and income limits.

How much can I borrow. The most common loan terms are 15 and 30 years though there are other terms available. While having fun with our mortgage calculator we.

Find and compare 30-year mortgage rates and choose your preferred lender. How much mortgage can you borrow on your salary. You are looking to change from your current rate to a new mortgage and borrow more on top of what you owe on your current mortgage.

The higher the percentage of the total house pricevalue that you borrow the higher percentage you will pay in insurance premiums. Please get in touch over the phone or visit us in branch. How much you can borrow for a mortgage in the UK is generally between 3 and 45 times your income.

Monthly Debts Pre-Mortgage. Over 222k Positive Reviews A Rating With BBB. Holders of federal debt as of September 30 2021 were the Federal Reserve 24 percent mutual funds 13 percent and financial institutions 9 percent.

Determine how much home you can afford with these helpful tips and questions to consider when budgeting for a mortgage. The bankruptcy process begins with a petition filed by the debtor which is most common. The largest US.

Our maximum mortgage calculator helps you calculate the maximum monthly mortgage payment and total mortgage amount you can afford. Home price example assumes a 30-year fixed interest rate of 40 on a home purchase in Florida with a 097 annual property tax rate and a 600 annual homeowners insurance premium. This is probably one of the two biggest factors that determine how much you can afford.

Find out what you can borrow.

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

/what-are-differences-between-delinquency-and-default-v2-dfc006a8375945d4b63bd44d4e17ffaa.jpg)

Delinquency Vs Default What S The Difference

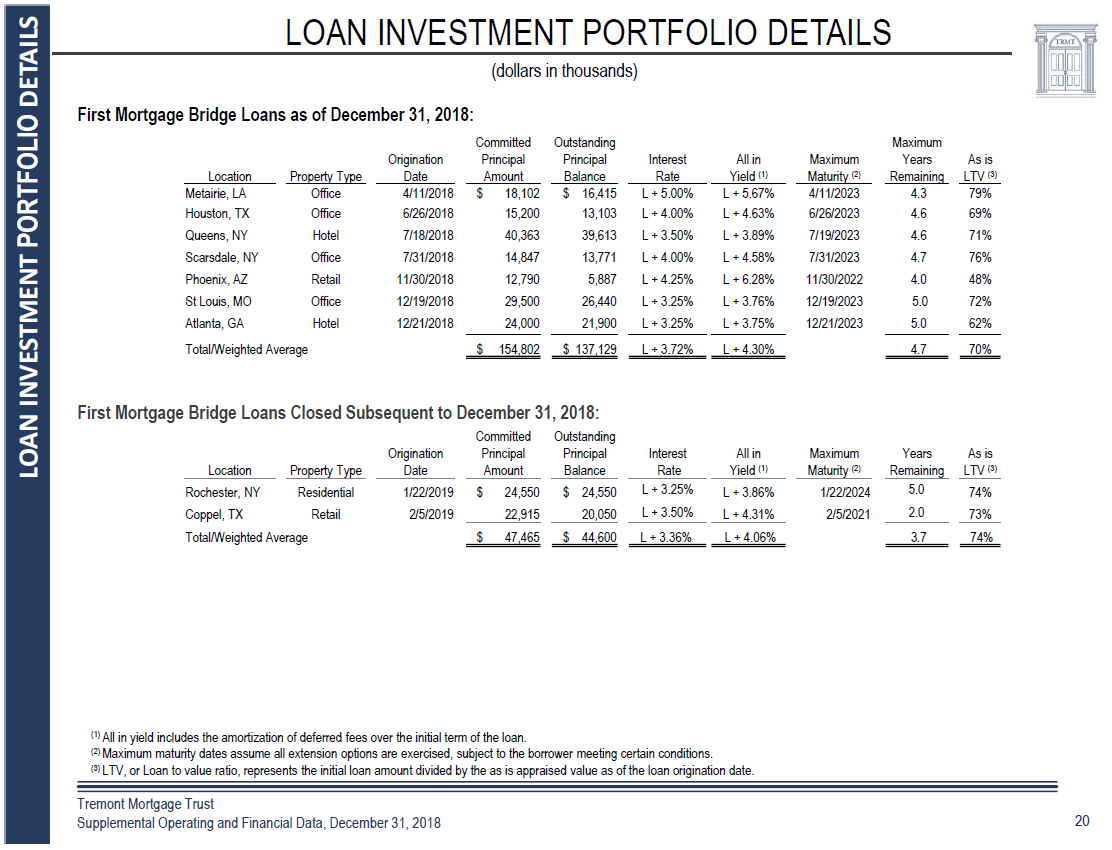

Tremont Mortgage Trust A Microcap Reit Turnaround That Offers A 16 Future Dividend Yield Or 70 Upside Nasdaq Sevn Seeking Alpha

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

Dave Ramsey In Most Places Homes Cost A Lot More Than This Example But The Proportions On This Comparison Remain The Same A 15 Year Mortgage Is The Only Way To Go

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

Tremont Mortgage Trust A Microcap Reit Turnaround That Offers A 16 Future Dividend Yield Or 70 Upside Nasdaq Sevn Seeking Alpha

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

30 Loan Application Forms Jotform

Tougher Times For Home Loan Approvals Japan Property Central

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

Line Of Credit Mobile Dashboard Line Of Credit Lending App Banking App

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Excel Ppmt Function With Formula Examples